Wells Fargo Former CEO Banned

In what the Wall Street Journal calls “unprecedented” and “an extraordinary sanction for a top executive at a large bank,” former CEO John Stumpf has been barred from the banking industry. The decision—and a $17.5 million fine—were part of a settlement between Stumpf and the Office of the Comptroller of the Currency (OCC) for millions of fake bank accounts created at Wells Fargo.

The OCC concluded that Stumpf should have known of the systemic problems and that “there was a culture in the Community Bank that resulted in systemic violations of laws and regulations.” When the scandal became public, employees complained of extreme stress because of pressure to sell more bank products. This pressure led employees to create fake accounts for customers.

Other Wells Fargo executives have been fined and charged, but none have been banned from the industry.

Discussion:

Do you think the decision is fair? Why or why not?

This decision represents a shift from the 2008/2009 financial crisis, when banks paid significant fines but very few individuals were charged. What’s your view of the change?

Emails Show USC's Potential Role in the Admissions Scandal

Actress Lori Loughlin and her fashion-designer husband Mossimo Giannulli have been charged with bribing University of Southern California athletic officials to get their daughter admitted. Now emails from USC show that the school was courting them by asking for donations and arranging for personalized campus tours. In one email, a university official wrote, “I’d also be happy to flag her application.”

A New York Times article summarizes how accused parents plan to defend themselves against charges:

Motions by several of the defendants suggest they will argue, essentially, that they could not have defrauded the university, as prosecutors say, because the university was actively seeking such donations and offering a leg-up in admissions in return.

In a statement, USC downplayed the special treatment:

“What was being offered to the Giannullis was neither special nor unique. Tours, classroom visits and meetings are routinely offered. The primary purpose of a flag is to be able to track the outcome of the admission review process. It is not a substitute for otherwise being qualified for admission to USC.”

Parents are expected to say that their donations were legitimate, but USC is expected to say that the bribery was specific to the crew team official, who “agreed to pass the couple’s two daughters off as coxswains.”

Discussion:

What’s your view of this situation? Do you agree more with the parents’ or with the school’s perspective?

What, if anything, do the school’s emails reveal? Consider this message to the parents: “Please let me know if I can be at all helpful in setting up a 1:1 opportunity for her, customized tour of campus for the family, and/or classroom visit?”

WSJ Opinion About Boeing Emails

A Wall Street Journal writer argues that Boeing employee emails “explain nothing.” A previous WSJ article concluded that emails demonstrated a “cavalier attitude towards safety,” and a Reuters article concluded that employees “distrust the 737 MAX” and “mock regulators.”

The opinion writer, Holman Jenkins Jr., argues, “all of corporate America, not just Boeing, lives these days by employing creative, freethinking people who spout off acerbically, critically and colorfully in electronic messages.” Jenkins questions the reporting of these emails and what is omitted.

Jenkins also asks why these employees didn’t write about MCAS design flaws: “If the hypercritical people seen in these messages had known about MCAS’s design flaws, it never would have gotten through.” He also notes that the only emails referring to MCAS were from 2013, although system changes were made in 2016.

Discussion:

Read Jenkins’ article. What do you consider to be his strongest and weakest arguments?

Based on his argument and your own reading of media reports, what’s your opinion about the significance of the emails?

What issues of integrity does this situation raise?

Boeing's Crisis Communication Plan

During the holiday break, several news items about Boeing were relevant to business communication and character. In one article, the New York Times revealed internal Boeing documents showing a company trying to rebuild its image after two MAX crashes within a year..

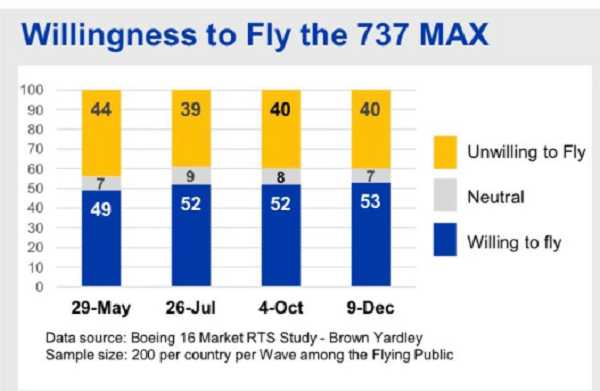

The documents give us an inside view of how the company plans to use persuasive strategies to win back customers. In one graphic, we see customers’ willingness to fly. In another, we see customer concerns and ways Boeing can address them, for example, with FAQ cards, “pilot confidence videos,” or personal connections (for example, “Flight attendant offers comfort and information on the safety of the MAX”).

Discussion:

What persuasive strategies does the company plan? Try to find examples of logical argument, emotional appeal, and credibility.

What are the consequences of this information becoming public? Does it likely endear the public to the company’s concerns, embarrass the company, or something else?

Data in the Uber's Safety Report

Uber published its first safety report, and the company is lauded for its transparency. A Wall Street Journal article leads with the number of sexual assaults reported during the last two years: 5,981. Of course, any number is too many—no one should be assaulted in an Uber or anywhere else. And sexual assaults are notoriously underreported, so we have no idea how many have actually occurred.

At the same time, a skeptic might want to know the total number of rides in order to put the number of reports in context. The report does provide this information (see the report for footnotes):

The report makes additional attempts to put the numbers in context:

All of that work culminates in the Safety Report that we are sharing with you, the public, today. To put US safety challenges in context:

• In 2018, over 36,000 people lost their lives in car crashes in the United States alone (3)

• Approximately 20,000 people were the victims of homicide in 2017(4)

• Nearly 44% of women in the US have been a victim of sexual violence in their lifetime—which means that more than 52 million women live with that experience every day (5)

Every form of transportation is impacted by these issues. For example, the NYPD received 1,125 complaints of sex offenses in the transit system during the same time period covered by this report.(6,7) In the United States alone, more than 45 rides on Uber happen every second. At that scale, we are not immune to society’s most serious safety challenges, including sexual assault. Yet when collecting data for that portion of our report, we found there was no uniform industry standard for counting and categorizing those types of incidents.

The 84-page report is incredibly detailed and includes external reports for credibility and the number of charges for various types of assaults.

Discussion:

Analyze the report: the audience, communication objectives, organization, writing style, format. What works well, and what could be improved?

Does the context in these examples convince you that the numbers aren’t so bad? Why or why not?

Otherwise, how well does Uber address the safety issues? How do you assess the report credibility? What other questions do you have?

Microsoft's Diversity and Inclusion Report

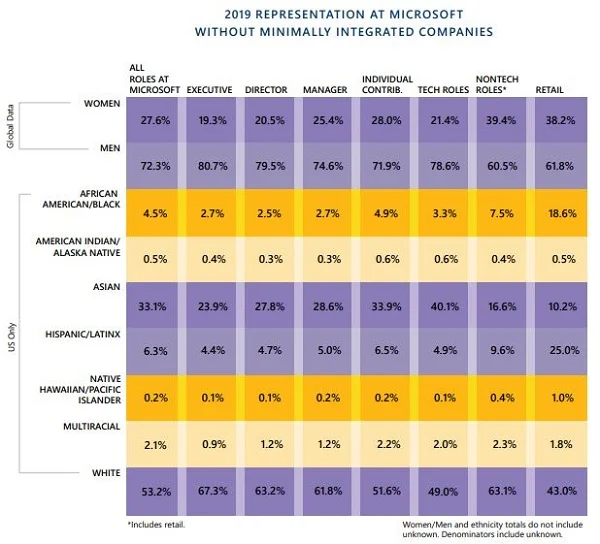

Microsoft’s 2019 Diversity and Inclusion report is the company’s sixth since 2014.

In the introductory letter, we learn about positive changes in demographic data:

In technical roles alone, we have 49% more women, 48% more Hispanic/Latinx, and 67% more African American/Black employees than we did three years ago. And beyond population growth, this year’s snapshot shows diversity representation has risen in every demographic category we track.

The report includes a few dazzling graphics, such as the one shown here.

Discussion:

Read the entire report. What principles of business communication are followed?

What suggestions for improvement would you suggest to the report authors?

What’s your view of the graphic shown here? What is the main point? How else could the data be shown?

Although the report writers acknowledge that some of the diversity increase in technical roles is attributed to employee growth, what other questions might a skeptic ask?

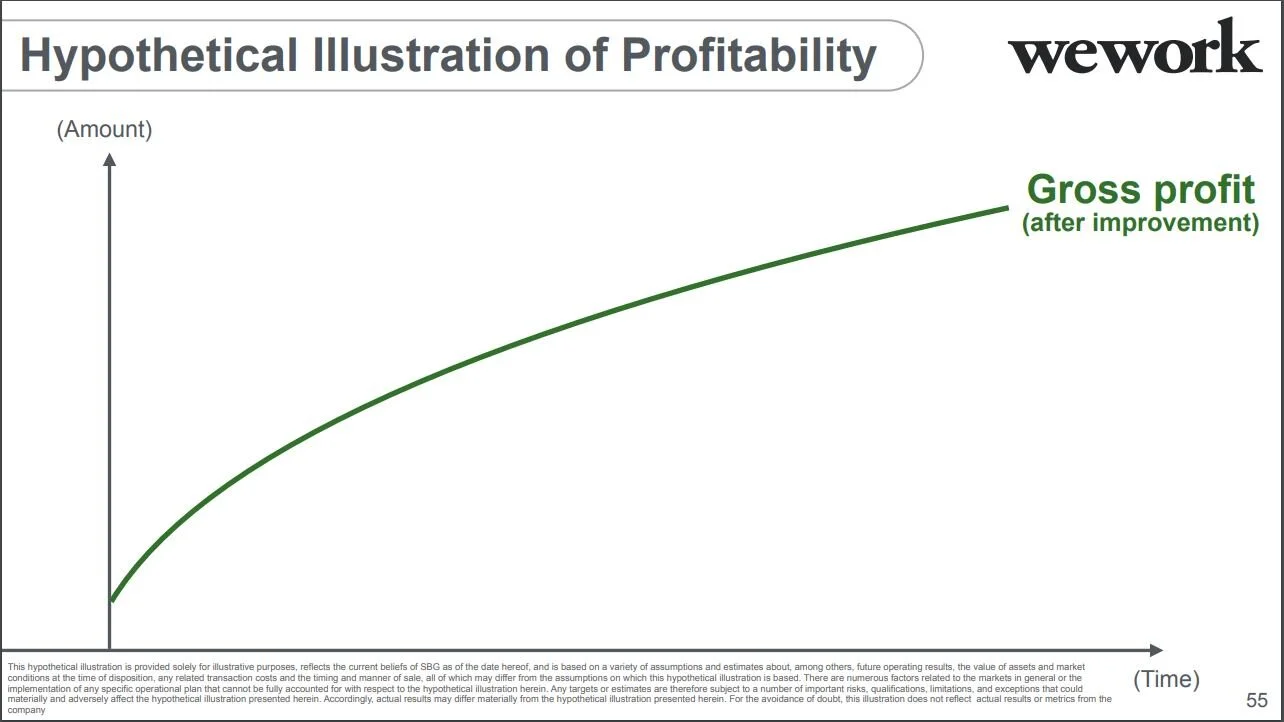

SoftBank's Vague WeWork Slides

SoftBank already took a financial hit because of its investment in WeWork. Now, the company is facing criticism about its data analysis and presentation.

A deck SoftBank Group (SBG) used to justify its WeWork investment includes several “hypothetical” and vague slides, like this one.

If you’re having trouble reading the footnote, here it is:

This hypothetical illustration is provided solely for illustrative purposes, reflects the current beliefs of SBG as of the date hereof, and is based on a variety of assumptions and estimates about, among others, future operating results, the value of assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions on which this hypothetical illustration is based. There are numerous factors related to the markets in general or the implementation of any specific operational plan that cannot be fully accounted for with respect to the hypothetical illustration herein. Any targets or estimates are therefore subject to a number of important risks, qualifications, limitations, and exceptions that could materially and adversely affect the hypothetical illustration presented herein. Accordingly, actual results may differ materially from the hypothetical illustration presented herein. For the avoidance of doubt, this illustration does not reflect actual results or metrics from the company.

The slide title is also odd: the illustration isn’t hypothetical, but the profitability is.

Discussion:

How might this chart affect SoftBank’s credibility?

What other examples in the SoftBank deck are problematic?

What leadership character dimensions are illustrated by this situation?

Letter from WeWork Employees

As WeWork plans layoffs, employees are asking for input into what happens to them and their peers. Referring to themselves as WeWorkers Coalition, the employees wrote a letter to the management team.

To the We Company Management Team:

WeWork’s company values encourage us to be “entrepreneurial, inspired, authentic, tenacious, grateful and together.” Today, we are embracing these qualities wholeheartedly as we band together to ensure the well-being of our peers.

We come from many departments across the company: building maintenance, cleaning, community, design, product, engineering and more. We believe that in the upcoming weeks we have the unique opportunity to demonstrate our true values to the world. This is a company that has inspired many of us, challenged us, and has been a formative personal and professional experience for those of us who began our careers here. WeWork has been not just a workplace, but a source of friendships and inspiration along the way.

We also believe our product can have a lasting positive impact on the world. We want to improve workplace happiness for millions of office workers and support small and medium sized businesses in their entrepreneurial efforts. We have been proud to support these goals and dedicate our time and talent to achieve them. This has been our story so far.

Recently, however, we have watched as layers are peeled back one-by-one to reveal a different story. This story is one of deception, exclusion and selfishness playing out at the company’s highest levels. This is a story that reads as a negation of all our core values. But this story is not over.

Thousands of us will be laid off in the upcoming weeks. But we want our time here to have meant something. We don’t want to be defined by the scandals, the corruption, and the greed exhibited by the company’s leadership. We want to leave behind a legacy that represents the true character and intentions of WeWork employees.

In the immediate term, we want those being laid off to be provided fair and reasonable separation terms commensurate with their contributions, including severance pay, continuation of company-paid health insurance and compensation for lost equity. We are not the Adam Neumanns of this world — we are a diverse work force with rents to pay, households to support and children to raise. Neumann departed with a $1.7 billion severance package including a yearly $46 million “consulting fee” (higher than the total compensation of all but nine public C.E.O.s in the United States in 2018). We are not asking for this level of graft. We are asking to be treated with humanity and dignity so we can continue living life while searching to make a living elsewhere. In consideration of recent news, we will also need clarity around the contracts our cleaning staff will be required to sign in order to keep their jobs, which are being outsourced to a third party. Those of us who have visas through WeWork need assistance and adequate time to find a new employer to sponsor our respective visas.

In the medium term, employees need a seat at the table so the company can address a broader range of issues. We’ve seen what can happen when leadership makes decisions while employees have no voice. We will need to see more transparency and more accountability.

We also need the thousands who maintain our buildings and directly service members to receive full benefits and fair pay, rather than earning just above minimum wage.

We need allegations of sexual misconduct and harassment to be taken seriously, acted on immediately and resolved with transparency.

We need diversity and inclusion efforts to materialize into real actions, not just talking points at company meetings.

We need salary transparency so we can surface and address systemic inequalities.

We need an end to forced arbitration contracts, which strip employees of their right to pursue fair legal action against the company.

We need all of this, and more.

In the long term, we want the employees who remain at WeWork, and those who join in the future, to inherit something positive we left behind. We want them to never find themselves in this position again, and for that to happen, they need a voice.

With this letter we are introducing ourselves, the WeWorkers Coalition. We are taking full advantage of our legal right to establish this coalition, and in doing so, we hope to give the future employees of WeWork the voice we never had.

We want to work with you. Please join us in writing a better ending to this chapter of the WeWork story.

By this Thursday at 5:00 p.m. EST, we would like to receive confirmation of your receipt of this letter and an indication of your willingness to meet us.

The WeWorkers Coalition

@weworkersco • info@weworkersco.org • #weworkers-coalition

Discussion:

What principles of business writing do the employees follow?

What persuasive strategies do they use in the letter? Find examples of logical argument, emotional appeal, and credibility.

What do you consider the strongest and weakest arguments?

What leadership character dimensions are illustrated in this situation?

Boeing CEO Responds to Questions

This week, Boeing CEO Dennis Muilenburg answered lawmakers’ questions about the two Max 737 plane crashes in the past year. Facing families of deceased passengers, Muilenburg began his testimony with an apology:

“I’d like to begin by expressing my deepest sympathies to the families and loved ones of those who were lost in the Lion Air Flight 610 and Ethiopian Airlines Flight 302 accidents, including those who are here in the room today. I wanted to let you know, on behalf of myself and all of the men and women of Boeing, how deeply sorry I am. As we observe today the solemn anniversary of the loss of Lion Air Flight 610, please know that we carry the memory of these accidents, and of your loved ones, with us every day. They will never be forgotten, and these tragedies will continue to drive us to do everything we can to make our airplanes and our industry safer.”

One of the most tense moments was when Senator Ted Cruz questioned Muilenburg (see video). Muilenburg also faced criticism as he was leaving. The mother of a victim of the second crash responded to his invoking his Iowa farm background:

“Go back to Iowa. Do that.” She also said, “I don't feel like you understand. It's come to the point where you're not the person anymore to solve the situation."

Discussion:

Watch more of Muilenburg’s testimony. What are some examples of questions he addressed well, and how could he have done better?

How well does Muilenburg balance emotional appeals, logical arguments, and credibility in his testimony?

What leadership character dimensions are illustrated by this situation and by Muilenburg’s testimony?

Muilenburg’s interaction with the mother is a difficult situation for anyone to handle, and we can certainly understand her grief and anger. How would you have responded?

CNN reports:

“In response, Muilenburg said he respects her viewpoint. "But I want to tell you the way I was brought up. And I'm just being honest here about it. I learned from my father in Iowa ... when things happen on your watch you have to own them and you have to take responsibility for fixing them," he said.

Plain Language from Financial Advisers

A Wall Street Journal writer asks financial advisers to speak to us in plain English. A new Securities and Exchange Commission rule—described in 564 pages—calls for simpler writing. But the author wants advisers to go further, for example, to use more visuals and categories: “color-coded from red to green, for instance, or arrayed on a scale from 1 to 10.”

Fortunately, the rule includes a summary, although students of business communication will find problems:

The Securities and Exchange Commission (the “Commission” or the “SEC”) is adopting new rules and forms as well as amendments to its rules and forms, under both the Investment Advisers Act of 1940 (“Advisers Act”) and the Securities Exchange Act of 1934 (“Exchange Act”) to require registered investment advisers and registered broker-dealers (together, “firms”) to provide a brief relationship summary to retail investors. The relationship summary is intended to inform retail investors about: the types of client and customer relationships and services the firm offers; the fees, costs, conflicts of interest, and required standard of conduct associated with those relationships and services; whether the firm and its financial professionals currently have reportable legal or disciplinary history; and how to obtain additional information about the firm. The relationship summary will also reference Investor.gov/CRS, a page on the Commission’s investor education website, Investor.gov, which offers educational information to investors about investment advisers, broker-dealers, and individual financial professionals and other materials. Retail investors will receive a relationship summary at the beginning of a relationship with a firm, communications of updated information following a material change to the relationship summary, and an updated relationship summary 2 upon certain events. The relationship summary is subject to Commission filing and recordkeeping requirements.

Plain language in government documents started as an initiative in the 1990s, and the group highlights before-and-after examples.

Discussion:

How could you rewrite the summary, above, for easier reading?

Review the Plain Language website. What are your impressions of the group’s work?

Business Leaders Sign Letter to Top Officials

Fifty CEOs and business school leaders signed a letter to President Trump and other top-ranking politicians urging action to allow for more international applications. The letter comes after a report by the Graduate Management Admissions Council showing declining applications.

Report conclusions follow:

[A]llowing top talent to study and work in the country of their choice helps create jobs, not take them. It offers insight into changing trends for historically talent-attracting and talent-supplying countries. Business school applications are a powerful metric—and forecast—of the success of individual economies in prioritizing talent and therefore leading innovation and growth. A survey of these latest metrics shows change in our midst—and for certain economies, warning signs for the future.

In their letter, the business leaders write that the U.S. is “needlessly capping our growth and can do better.” They urge U.S. politicians to allow more movement by taking the following action:

Removing “per-country” visa caps, modernizing our visa processing system, and reforming the H-1B visa program to make it possible for the most talented people to have a reasonable chance of gaining entry to the United States.

Creating a “heartland” visa that encourages immigration to the regions of the United States that could most use the vitality of these talented individuals.

Discussion:

Analyze the letter. Who are the primary and secondary audiences? What are the communication objectives? How do you assess the organization and writing style?

What persuasive communication strategies do the writers use? Which are most and least effective?

Analyze the report using the same questions.

How well does the infographic summarize the report conclusions? What could be improved?

Reciprocity in the News

Students of persuasion likely learned about reciprocity. In my class, we discuss reciprocity as a logical reasoning type and as one of Cialdini’s six principles of persuasion. We also talk about quid pro quo, meaning “this for that,” as a type of sexual harassment.

Steven Pinker, a cognitive scientist at Harvard, wrote an opinion piece in the New York Times titled, “A Linguist’s Guide to Quid Pro Quo,” referring to the discussions between President Trump and Ukrainian President Volodymyr Zelensky.

President Trump and his supporters have gone to the heart of the issue, denying any quid pro quo. Senator Lindsey Graham of South Carolina tweeted, “What a nothing (non-quid pro quo) burger.” Defenders also say that this type of reciprocity is common for political leaders.

Pinker believes that an explicit “if,” “then” construction isn’t necessary for a quid pro quo agreement:

It’s true that the transcript of the reconstructed conversation does not reveal a smoking sentence with an “if” and a “then.” But to most readers, Mr. Trump’s claim that he was merely musing about his druthers does not pass the giggle test. That is because people in a social relationship rarely hammer out a deal in so many words but veil their offers in politeness and innuendo, counting on their hearers to listen between the lines.

More typically, we see politeness in reciprocal transactions. During the call, President Trump said, “I would like you to do us a favor though.”

This article also raises issues about a “transcript,” which he describes as a reconstructed conversation. The summary isn’t verbatim, and it’s unclear whether a recording exist.

Discussion:

Describe reciprocity as a method of influence. What is the value to business relationships, and what dangers should be avoided?

Talk about a time when you practiced reciprocity, but it felt imbalanced—either for you or for the other person? How did it feel? How can avoid this in the future?

In this case, do you think President Trump crossed a line, or do you believe his statement, “There was no quid pro quo”?

LeBron James Enters the Tweet Debate

As the NBA struggles to recover after Houston Rockets General Manager Daryl Morey tweeted in support of Hong Kong protesters, LeBron James questioned Morey’s choice:

“Yes, we all do have freedom of speech. But, at times, there are ramifications for the negative that can happen when you’re not thinking about others, when you’re only thinking about yourself. . . . I believe he wasn’t educated on the situation at hand, and he spoke. And so many people could have been harmed, not only financially, but physically, emotionally, spiritually. So just be careful. . . .”

The Wall Street Journal reports that people were “stunned” by his comment because James is typically careful about his public comments.

Discussion:

What’s your view of James’ commenting on the situation? Should he have avoided commenting? Why or why not?

What’s your view of his comments? How well did he handle the situation?

What leadership character dimensions are illustrated by James’ comments?

NBA Tweetstorm

The NBA is thrust into a political quagmire after Houston Rockets general manager Daryl Morey tweeted in support of the Hong Kong protesters: '“Fight for Freedom. Stand with Hong Kong.” The tweet has since been deleted.

NBA Commissioner Adam Silver is dancing a line between protecting Morey’s free speech and staving off China’s backlash. Critics say the league is driven by profit instead of principle. He has tried to clarify his position:

“It is inevitable that people around the world — including from America and China — will have different viewpoints over different issues. It is not the role of the NBA to adjudicate those differences. However, the NBA will not put itself in a position of regulating what players, employees and team owners say or will not say on these issues. We simply could not operate that way.”

At this point, The Wall Street Journal reports better news:

“The situation appears to have de-escalated. After a week of blistering anti-NBA rhetoric in Chinese media, the government is signaling that it’s time to cool it, a message that includes the vitriol directed at the Rockets, according to one person familiar with the situation.”

But the Journal also acknowledges: “China’s love affair with the Rockets might not be the same again.”

Discussion:

Should Morey have avoided sending the tweet? Why or why not?

How do you assess the league’s response to the situation?

Analyze Silver’s news conference. What did he do well, and what could he have done differently?

WeWork: "Humbler"

Several articles in the past few weeks have scolded WeWork CEO Adam Neumann and the investors who followed his story.

The Wall Street Journal was the first to describe Neumann’s odd behavior and published another article, “WeWork Investors Turned Off by ‘Sloppy’ IPO Filings.” The recent article explains one problem in the filings (shown below):

“A section headed ‘illustrative annual economics’ that assumed 100% workstation utilization vanished, for example, as did two graphs portraying a typical location going from ‘-$’ to ‘+$,’ with no y-axis showing the actual dollar amounts being depicted.”

A New York Times article, “Was WeWork Ever Going to Work?” criticizes investors for missing obvious problems with the company’s initial business plan, such as the reliance on start-up revenue when most entrepreneurial ventures fail. According to this report, it took people finally looking at the data to realize how much We is losing and how hard it will be for the company to succeed.

The article includes other examples of investors’ blind exuberance:

“It is not merely money that separates the ruling class from the rest of the country. Often it seems as if it is the gaping difference in the application of common sense. Ultimately, it was the bankers, technocrats, statesmen and acolytes of the data-junkie class who were willing to believe that Elizabeth Holmes, a 19-year-old college dropout who thought a black turtleneck would make her Steve Jobs, was going to revolutionize blood-testing. It didn’t seem to matter that she could not deliver any real evidence to prove it.”

An Inc. article, “The Future of WeWork: Leaner, Humbler, and Duller,” suggests a new path for We. The author suggests less hype, fewer employees, and more discipline for the company to survive.

Discussion:

Who do you blame for WeWork’s failed IPO?

If you believe the New York Times article, investors are gullible. Do you agree with this assessment? If so, why might this be the case?

Read the “Note”—the fine print—under the table, shown above. How do you interpret this information?

What should We do now to build credibility and save the business?

WeWork Co-Founder and CEO Steps Down

WeWork announced that Adam Neumann will leave his position after controversy about the company’s financial situation and the co-founder and CEO’s behavior. Within a week, the company went from preparing for an IPO to facing criticism that led to this ouster and a delayed public offering.

The company valuation has been reduced from about $47 to $15 billion based on governance issues and what the Wall Street Journal calls “ballooning losses.” The Journal also reported on Neumann’s “eccentric behavior,” including a heavy-party lifestyle that recently involved bring marijuana on a plane to Israel and saying that he might like to be the prime minister.

In its news release, WeWork provided scant information and a few quotations, including this from Neumann:

“As co-founder of WeWork, I am so proud of this team and the incredible company that we have built over the last decade. Our global platform now spans 111 cities in 29 countries, serving more than 527,000 members each day. While our business has never been stronger, in recent weeks, the scrutiny directed toward me has become a significant distraction, and I have decided that it is in the best interest of the company to step down as chief executive. Thank you to my colleagues, our members, our landlord partners, and our investors for continuing to believe in this great business.”

Discussion:

Compare the company’s news release to others announcing CEO departures. How does this one differ, and why would the company take this approach?

What are the communication objectives of Neumann’s statement? How well does his quote meet those objectives? What else, if anything, should Neumann say or do?

Amazon Response to Employee Walkout

Like many around the world during the Global Climate Strike, hundreds of Amazon employees walked out of their offices yesterday. Employees have been urging Amazon leaders to take more steps to reduce fossil fuel dependency and wrote an open letter back in April. The pressure seems to be working.

On Thursday, CEO Jeff Bezos announced The Climate Pledge, with the following commitments:

Commits to net zero carbon by 2040 and 100% renewable energy by 2030

Orders 100,000 fully electric delivery vehicles, the largest order ever for electric delivery vehicles

Invests $100 million in reforestation projects around the world to begin removing carbon from the atmosphere now

Launches new sustainability website to report progress on commitments

The Pledge encourages other businesses to sign on, with Amazon leading the way. Bezos said, “We’re done being in the middle of the herd on this issue — we’ve decided to use our size and scale to make a difference.” Amazon employees reacted positively.

Discussion:

Analyze the employees’ open letter. What persuasive strategies do they use? Look for examples of logical argument, emotional appeal, and credibility. What organizational strategies do the writers use?

The Amazon announcement doesn’t mention employees’ influence in the decision, although news articles and employees make the connection. Should Bezos include this recognition? Why or why not?

Describe a CEO’s dilemma in situations like these. When is it appropriate for leaders to meet their employees’ demands, and when should they resist? Did Bezos take the best course of action?

The Purpose of the Corporation

The Business Roundtable published a statement, The Purpose of the Corporation, signed by 181 of its 193 members. The Roundtable, a corporate lobbying group, includes CEOs of the largest U.S. companies.

In essence, the CEOs write that they have responsibilities beyond shareholders—to customers, employees, suppliers, and communities (including the environment). The statement is a step to improving the perception of businesses as solely driven by creating shareholder value through short-term profits.

Skeptics abound. A writer for the Washington Post called the statement a “truism”:

“What’s significant about the statement is what it does not say. The corporate signatories do not suggest in any way weakening the fiduciary duties of the boards and managers of ordinary for-profit shareholder corporations to manage such companies’ affairs for shareholders’ benefit.”

The CEO of Allstate and head of the U.S. Chamber of Commerce wrote an opinion piece in the New York Times encouraging businesses to pay people more if they’re serious about serving more stakeholders.

A writer for Forbes argued that these companies are multinationals and have global responsibilities as well. He also accused the executives of being self-serving, warding off criticism about executive compensation.

Others noted company CEOs who didn’t sign, for example, Alcoa, Blackstone, GE, NextEra, Parker Hannifin, and Wells Fargo (whose representative said the CEO is interim and wasn’t asked to sign). Some companies, for example, Kaiser and State Farm, say they didn’t sign because they don’t have shareholders.

Discussion:

What’s your view of the statement: significant, placating, diverting, or something else?

Assess the statement itself. Consider the audience, purpose, writing style, organization, and so on. What works well, and what could be improved? What’s extraneous and what’s missing?

Overstock CEO Resigns

Overstock CEO Patrick Byrne resigned after admitting to a relationship with Russian agent Maria Butina. Butina is serving prison time because of her attempts to gain political access during the 2016 U.S. presidential election.

Byrne announced his decision in a letter to shareholders. He begins with the news:

“In July I came forward to a small set of journalists regarding my involvement in certain government matters. Doing so was not my first choice, but I was reminded of the damage done to our nation for three years and felt my duty as a citizen precluded me from staying silent any longer. So, I came forward in as carefully and well-managed fashion as I could. The news that I shared is bubbling (however haphazardly) into the public. Though patriotic Americans are writing me in support, my presence may affect and complicate all manner of business relationships, from insurability to strategic discussions regarding our retail business. Thus, while I believe that I did what was necessary for the good of the country, for the good of the firm, I am in the sad position of having to sever ties with Overstock, both as CEO and board member, effective Thursday August 22.”

Byrne’s letter then describes his thinking about Overstock, including blockchain technology, retail, and strategy.

This announcement came 10 days after Byrne wrote a news release titled, “Overstock.com CEO Comments on Deep State, Withholds Further Comment.” In that post, he refers to “Men in Black” and his “Omaha Rabbi,” reinforcing perceptions that Byrne is a controversial figure.

MarketWatch shows the stock performance during this period.

Discussion:

What’s your view of Byrne’s decision to resign? Consider his history with Overstock, company performance, and the company trajectory.

CNN referred to Byrne’s first news release as “strange.” Do you agree?

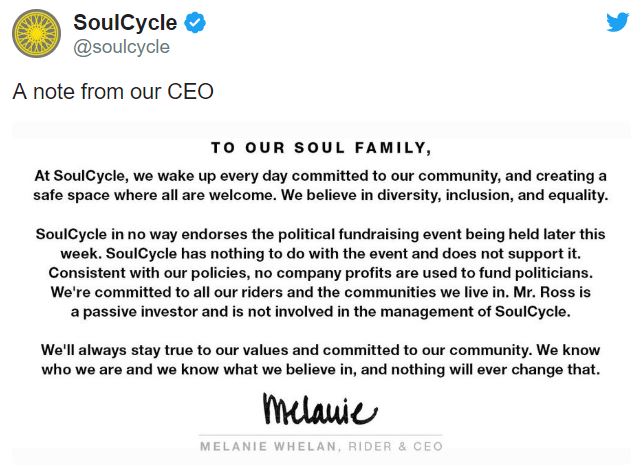

Backlash After President Trump Fundraiser

Equinox and SoulCycle customers are not happy about a fundraiser for President Trump sponsored by the companies’ owner, the chairman of a real estate firm. Threats of boycotts and cancelled memberships provoked quick responses from both companies.

SoulCycle CEO Melanie Whelan also said, “SoulCycle has nothing to do with the event and does not support it. … We know who we are and we know what we believe in, and nothing will ever change that.”

Capitalizing on the brands’ distress, other fitness companies are offering discounts and free trials to try to win business.

Discussion:

More company executives feel inspired towards political activism. What are the advantages and risks?

Did the real estate company owner, Stephen Ross, act inappropriately by hosting a fundraiser? Why or why not?

Analyze the companies’ statements. What persuasion strategies do they use to rebuild each brand?

Compare the statements. Does one work better than the other? What criteria do you use to compare them?