SoftBank's Vague WeWork Slides

SoftBank already took a financial hit because of its investment in WeWork. Now, the company is facing criticism about its data analysis and presentation.

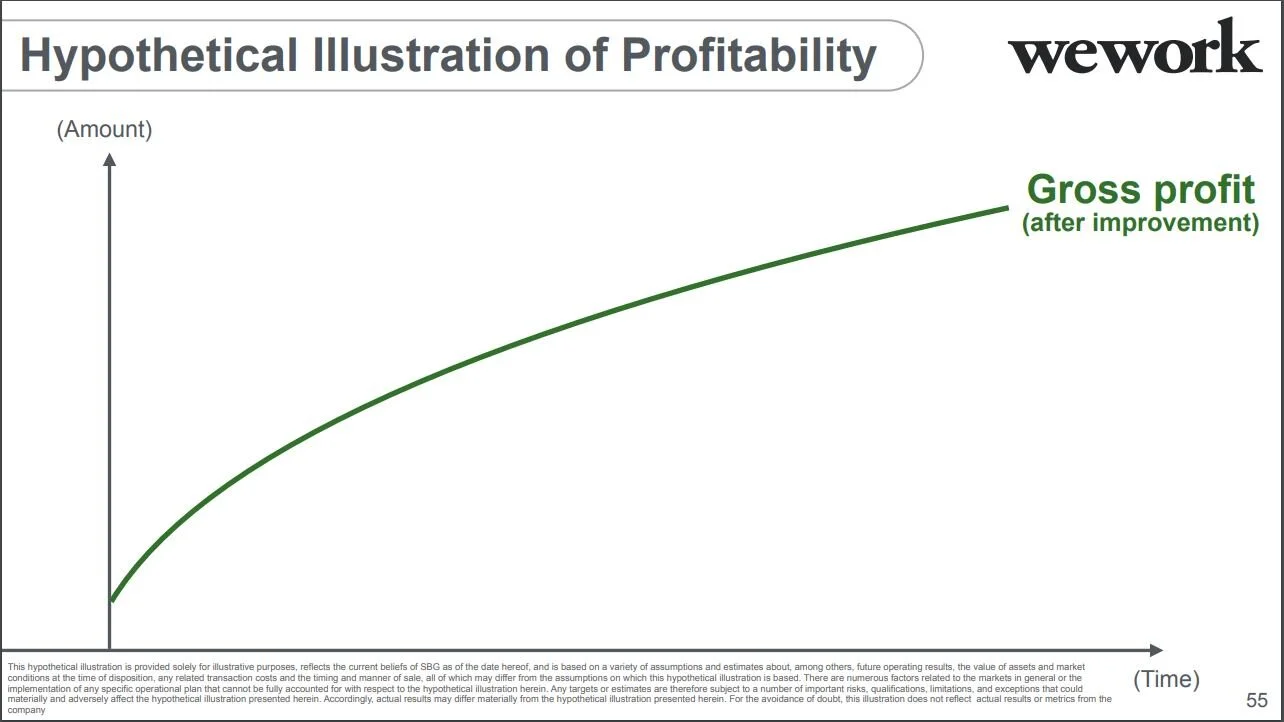

A deck SoftBank Group (SBG) used to justify its WeWork investment includes several “hypothetical” and vague slides, like this one.

If you’re having trouble reading the footnote, here it is:

This hypothetical illustration is provided solely for illustrative purposes, reflects the current beliefs of SBG as of the date hereof, and is based on a variety of assumptions and estimates about, among others, future operating results, the value of assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions on which this hypothetical illustration is based. There are numerous factors related to the markets in general or the implementation of any specific operational plan that cannot be fully accounted for with respect to the hypothetical illustration herein. Any targets or estimates are therefore subject to a number of important risks, qualifications, limitations, and exceptions that could materially and adversely affect the hypothetical illustration presented herein. Accordingly, actual results may differ materially from the hypothetical illustration presented herein. For the avoidance of doubt, this illustration does not reflect actual results or metrics from the company.

The slide title is also odd: the illustration isn’t hypothetical, but the profitability is.

Discussion:

How might this chart affect SoftBank’s credibility?

What other examples in the SoftBank deck are problematic?

What leadership character dimensions are illustrated by this situation?